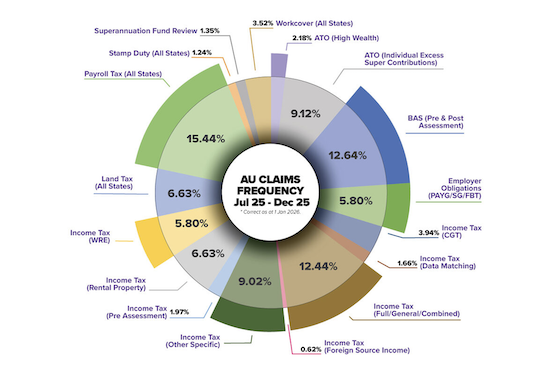

Audit claims activity across Australia Jul – Dec 2025

.

These technologies enable authorities to identify discrepancies with unprecedented precision, ensuring that businesses, self-managed superannuation funds, and individuals remain under scrutiny.

These are the three most common claim categories, as received by Audit Shield to their claims team for the period 1 July 2025 to 31 December 2025 and were correct as of 1 January 2026. These were:

- Payroll Tax (All States) – 15.44%

- BAS (Pre & Post Assessment) – 12.64%

- Income Tax (Full/General/Combined) – 12.44%

Together, these three categories accounted for nearly 41% of all Accountancy Insurance claims lodged during the period.

1. Payroll Tax Investigations (All States)

Payroll Tax Investigations continued as the most frequent claim type, representing 15.44% of all Accountancy Insurance claims for the period. This aligns with ongoing state revenue authority initiatives targeting employer compliance, particularly around grouping provisions and contractor classifications.

State breakdown:

- VIC: 29.53%

- NSW: 28.19%

- QLD: 24.16%

- WA: 16.11%

- TAS: 1.34%

- SA: 0.67%

2. BAS (Pre & Post Assessment) Audits and Reviews

BAS (Pre & Post Assessment) audits and reviews represented 12.64% of claims activity from 1 July 2025 to 31 December 2025, continuing an upward trend when compared with the period 1 July 2024 to 31 December 2024. The ATO’s focus on GST compliance remains a key driver, supported by enhanced data matching capabilities that compare BAS submissions against third-party data sources such as supplier reporting and banking transactions.

Breakdown:

- Post Assessment: 63.93%

- Pre Assessment: 36.07%

The dominance of post-assessment audits suggests a strong emphasis on verifying GST reporting accuracy after lodgement, particularly in sectors with high transaction volumes.

3. Income Tax (Full/General/Combined) Audits and Reviews

Income Tax audits and reviews accounted for 12.44% of total claims from 1 July 2025 to 31 December 2025, marking a notable increase from the previous financial year, where it stood at 11.60%. It also trended higher trend when compared with the period 1 July 2024 to 31 December 2024, where it was 12.04%.

To find out more information about Karaco Accountants Audit Shield cover please click here.